In the vast ocean of international trade, DDP (Incoterms) stand out as a beacon for many businesses and freight forwarders. They represent the epitome of clarity in a landscape often riddled with ambiguities. At its core, DDP – or Delivered Duty Paid – simplifies the shipping process by placing the maximum responsibility on the seller. In essence, from export clearance to arriving means at the buyer’s premises, the seller assumes all the costs and risks.

But what exactly are these costs? And how do intricacies like import clearance and customs formalities fit into the equation? These are questions that often hover in the minds of many, especially when shipping delays or unexpected costs come into play.

This guide is your navigational tool, charting the waters of DDP, demystifying the shipping costs, import duties, and customs clearance procedures, ensuring that your journey in international trade remains as smooth as possible. Whether you’re a seasoned player in the realm of international trade or just stepping into the vastness of its opportunities, understanding DDP is pivotal. Let’s set sail together and explore the depths of Delivered Duty Paid DDP.

DDP (Incoterms) Explained

DDP Incoterms, an abbreviation for Delivered Duty Paid, stands as one of the foundational pillars of international trade. But before we delve deeper, let’s establish a basic understanding:

Definition: DDP refers to an agreement where the seller takes on all responsibilities, risks, and costs associated with delivering goods to a final destination. This includes shipping costs, import duties, and customs clearance procedures. Essentially, the buyer can expect the goods to arrive at their doorstep without any additional obligations.

Responsibilities: The seller is responsible for export clearance in their country, transportation, and import clearance in the destination country. If there are any unexpected customs requirements or import clearance formalities, the seller bears those as well.

Costs: All transportation and delivery costs, including import duties and taxes in the buyer’s country, are borne by the seller. The buyer only pays the agreed-upon price of the goods.

Now, tracing the evolution of DDP:

Historically, international trade was a maze of shipping agreements, sales contracts, and unanticipated shipping delays. The International Chamber of Commerce, recognizing the complexities, introduced Incoterms in 1936 to streamline and standardize trade terms. DDP emerged as one of these terms, offering unparalleled clarity in transaction roles.

The significance of DDP in global shipping is profound. By clearly defining the responsibilities of sellers and buyers, DDP removes ambiguities, reduces disputes, and ensures smoother transactions. Especially for businesses that lack local destination knowledge or resources to deal with import clearance in foreign countries, DDP offers a convenient and risk-averse option.

In essence, DDP Incoterms have revolutionized global shipping by establishing a system where roles, responsibilities, and costs are transparent, ensuring both parties can engage in international trade with confidence and clarity.

Delivered Duty Paid (DDP): Beyond the Basics

Navigating the world of international trade can be intricate, but with terms like Delivered Duty Paid (DDP), the path becomes clearer. Let’s delve deeper into the nuances of DDP.

Breaking down the term: What does “delivered duty paid” entail?

Delivered Duty Paid is not just a term but a commitment. It means:

Delivered: The seller ensures the safe delivery of goods right to the buyer’s specified location.

Duty: All customs duties, import duties, and other related taxes are handled by the seller. This ensures that the buyer doesn’t face unexpected costs.

Paid: The seller bears all costs from the start of the shipping process up to the final delivery. This includes not just delivery costs, but also transportation, customs documentation, and even import clearance procedures.

Buyer and Seller: Roles and Responsibilities under DDP

Buyer’s Role:

Wait for the goods to arrive at the specified destination.

Pay the agreed price for the goods, without having to worry about additional costs or unforeseen shipping intricacies.

Seller’s Role:

Ensure goods are properly packed, often with export packaging, and ready for international transit.

Handle all export clearance and documentation required for transportation.

Cover all shipping costs and ensure goods arrive in the destination country without damage or delay.

Manage customs clearance, import duties, and all customs formalities in the buyer’s country.

The Interplay Between DDP and Other Incoterms

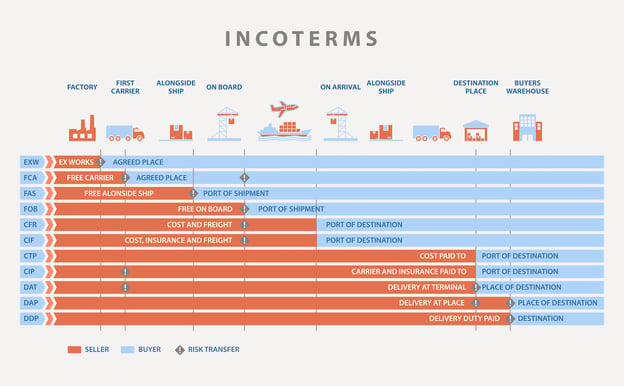

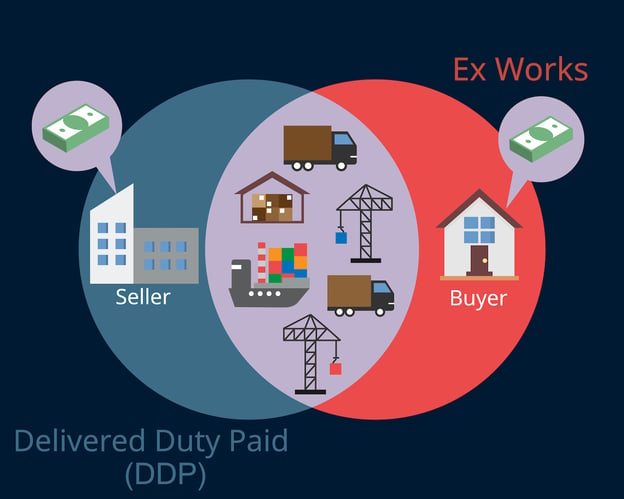

While DDP offers a comprehensive solution for both buyers and sellers, it’s one among several incoterms, each with its unique features. For instance, DDU (Delivered Duty Unpaid) is like DDP, but the buyer handles the import duties. Comparing DDP with other terms like FOB (Free on Board) or CIF (Cost, Insurance, and Freight) illuminates how roles and costs can shift depending on the agreement.

Understanding DDP in the broader context of incoterms ensures businesses can select the most appropriate term for their needs, ensuring smoother international trade experiences.

Shipping Costs: How They Factor Into DDP

In the intricate tapestry of international trade, shipping costs play a critical role. Especially under DDP Incoterms, where the seller bears the brunt of these costs, understanding their structure is vital for both parties involved.

The Anatomy of Shipping Costs: From Origin to Destination

Shipping costs are not as straightforward as they seem. They consist of:

Transportation Costs: These can involve multiple modes of transport, like sea freight, air, and road. Often, a freight forwarder or logistics company facilitates these transitions.

Customs Clearance: Incorporating the customs duties, import duties, and all associated fees for both export and import clearance formalities.

Delivery Costs: From the destination port to the final destination, which could be the buyer’s premises or a designated container yard.

How DDP Affects Cost Calculations and Budgeting for Businesses

Under Delivered Duty Paid (DDP), the seller assumes maximum responsibility. Not only do they handle the shipping process, but they also cover all the costs. This includes unpredictable ones like value-added tax, import clearance procedures, and any additional costs related to shipping delays or complications.

For buyers, this can simplify budgeting as they’re aware of the costs upfront – no nasty surprises. However, for sellers, it means thorough planning and often consulting with freight forwarders or logistics companies to get accurate estimates and ensure smooth, on-time deliveries.

Businesses considering DDP shipments should weigh the convenience against potential challenges, ensuring that their shipping agreement aligns with their broader objectives and capacities. The beauty of DDP lies in its comprehensive nature, where the seller delivers the goods right to the buyer’s doorstep, handling everything from packing to customs requirements. But this beauty comes at a cost, and understanding that cost is key for successful international trade.

Navigating Import Clearance with DDP

Import clearance stands as one of the most complex aspects of international trade. With a myriad of procedures, documentation, and often unpredicted fees, it can easily turn into a labyrinth for the unprepared. The DDP Incoterms framework, however, is designed to bring clarity and ease to this intricate process, especially for the buyer.

The Labyrinth of Import Clearance: Steps and Considerations

At its core, import clearance involves several distinct stages:

Documentation Review: Essential paperwork such as the commercial invoice, packing list, and certificates of origin are assessed.

Customs Duties and Taxes: Calculation and payment of import duties, value-added tax, and other levies associated with the incoming shipment.

Inspection and Verification: Depending on the destination country and nature of goods, certain shipments may undergo physical inspections or verifications to ensure compliance with local regulations.

The Crucial Role of Customs Formalities and Clearance Procedures

Clearing goods through customs isn’t merely about paying the necessary fees. It’s a comprehensive process that involves:

Understanding Customs Requirements: Each country has its specific customs requirements, which may pertain to the type of goods, their value, and their origin.

Ensuring Accurate Documentation: Errors in customs documentation can lead to delays, added costs, and even seizure of goods.

Managing Relationships with Customs Officials: In some cases, having an established relationship with customs officials or having local destination knowledge can facilitate a smoother clearance process.

How DDP Simplifies Import Clearance for the Buyer

Under the Delivered Duty Paid (DDP) framework, the seller takes on the lion’s share of responsibilities tied to import clearance. This means:

Hassle-Free for the Buyer: With DDP, the seller handles all import clearance formalities, sparing the buyer from diving deep into customs procedures.

Predictability in Costs: Since all costs, including customs duties and related charges, are covered by the seller, the buyer can better forecast their expenses without fear of unknown costs or unforeseen additional costs.

Assurance of Compliance: The seller ensures that all goods are compliant with the buyer’s country customs requirements, minimizing risks of delays or penalties.

By simplifying the import clearance maze, DDP provides buyers with an advantage, allowing them to focus on their core business while entrusting the intricacies of shipping and customs to the seller.

Delivered Duty Paid DDP: Real-world Scenarios

In the intricate web of global shipping and trade, Delivered Duty Paid (DDP) shines as a beacon of simplicity for many buyers. To better understand its practical applications, let’s delve into some real-world scenarios where DDP plays a pivotal role.

Examples Illustrating How DDP Works in Practice

A Toy Manufacturer in the US importing from China: A US-based toy retailer orders a shipment of toys from China. Under a DDP agreement, the Chinese supplier is responsible for producing the toys, shipping them, handling export and import formalities, paying all transportation costs, and ensuring safe delivery to the retailer’s premises in the US. The retailer, on the other hand, simply waits for the shipment to arrive at their doorstep without worrying about customs duties or other related charges.

A Fashion Brand in France sourcing fabrics from India: The brand finalizes a deal with an Indian supplier to receive specialized fabric. If the deal is on DDP terms, the supplier would take care of everything – from obtaining the necessary export clearance in India to ensuring that the fabric meets the import clearance procedures in France and is delivered to the brand’s designated location.

Benefits and Challenges of Opting for DDP Shipping

Benefits:

Simplicity for Buyers: No need to get involved in customs clearance formalities or bear unforeseen additional costs.

Cost Predictability: All shipping costs, including duties and taxes, are predefined, offering clarity to the buyer.

Assured Compliance: The seller guarantees the shipment abides by the buyer’s country customs requirements.

Challenges:

Higher Initial Costs: DDP prices may seem higher upfront since they include all costs, from production to final delivery.

Lack of Control for Buyers: Since the seller handles all aspects, buyers might feel they have less control over the shipping process or potential shipping delays.

Risk for Sellers: The seller assumes maximum responsibility, including potential risks associated with import duties or customs formalities.

DDP, as evident from the above scenarios, offers a balanced mix of pros and cons. The decision to opt for it largely depends on the specific needs and preferences of the involved parties.

Summing Up DDP & Its Impact on Global Trade

In the intricate tapestry of global trade, understanding Delivered Duty Paid (DDP) Incoterms remains paramount. DDP offers businesses an unambiguous framework, defining clear roles and responsibilities between buyers and sellers. Its unique blend of convenience, coupled with the transparency of costs, makes it an appealing option for many involved in international transactions.

Adapting to DDP terms can bring significant advantages. For buyers, it’s a breath of fresh air, simplifying the entire shipping process, eliminating the complexities of customs procedures, and ensuring that costs are predefined and transparent. For sellers, while it adds more responsibility, it provides a clear selling point and can be used as a competitive advantage in the market.

In sum, the world of international trade may seem daunting, but with tools like DDP Incoterms in place, the path becomes a tad clearer. It underscores the significance of clear communication, understanding, and mutual respect in ensuring smooth and hassle-free trade.